Blog

Financial Resolutions 3.0: What’s New for Ambitious Parents in 2026

Higher costs, more complex education decisions, evolving career paths, and growing family responsibilities mean that the way we approach those fundamentals must evolve

How Ambitious Parents Can Use the Holidays to Talk Money with Their Kids

December is one of the easiest and most natural times to help kids build financial awareness.

2025 Year-End Financial Checklist: 7 Smart Moves to Make Right Now

A few thoughtful steps now can reduce taxes, reinforce your long-term plan, and set you up for a strong start to 2026.

When “Enough” Isn’t Enough: Why Many Parents Undershoot Their Financial Plans

Many families aim for “just enough”, unfortunately, in a world of surprises, “just enough” often falls short.

Back to School: 5 Financial Lessons Every Family Can Learn This Fall

Just like math, reading, and science form the foundation of a student’s education, there are a few core money lessons that can anchor long term success for parents.

Top 3 Mistakes Parents Make When Saving for College and Planning for Retirement

You don’t have to choose one or the other. With the right strategy, you can invest in your child’s future and save for your own retirement.

Independence (Financial) Day

Financial independence is about having options and freedom. It means you’ve structured your finances in a way that lets you make decisions based on what’s best for your life.

5 Smart Moves to Make in Your Mid-Year Financial Checkup

Why Starting Early and Building Good Habits Pays Off in the Long Run

Learning Personal Finance and Teaching Kids Baseball

Surprisingly, there are a lot of similarities between baseball and personal finance. The rules are complicated, but the more experience you have the easier it gets.

Spring Cleaning Your Finances: 5 Tips for Simplifying your Financial Life

A simpler financial life is often a stronger one. Here are a few practical steps to help you simplify, streamline, and reset your wealth plan this spring.

Retirement vs. College: How Parents Can Fund Education Without Jeopardizing Their Future

We’ve all heard the “oxygen mask” analogy: take care of yourself first so you can help others. The same applies to your financial future!

Tax Season Prep: Key Moves to Make Before Filing Your 2024 Taxes

Tips on maximizing deductions and retirement contributions for 2024 and strategies for reducing taxable income and avoiding common mistakes in 2025.

Financial Resolutions 2.0: A Fresh Approach for Ambitious Parents in 2025

As the new year unfolds, it's time for ambitious parents to reassess their financial goals and take actionable steps to ensure a secure and prosperous future.

The Grandparent’s Guide to Gifting: UTMA, 529 Plans, and More

With several options available, it can be challenging to decide the best way to give financial gifts to your grandchildren.

Top 5 Year-End Charitable Giving Tips: Support the Causes You Care About and Maximize Tax Benefits

For many people, charitable giving is a meaningful way to support the causes they care about while also potentially gaining tax advantages.

Financial Planning Lessons from the Golf Course: Strategy, Patience, and Adaptability

Golf and financial planning rely on patience, strategy, and adaptability to succeed.

Navigating Financial Challenges for the Sandwich Generation: Top 5 Things to Consider

Balancing these responsibilities can feel overwhelming, especially when considering the costs of healthcare for aging parents, education for children, and personal financial needs, such as saving for retirement.

Buying vs. Leasing a Vehicle: A Guide for Ambitious Parents

Let’s dive into the pros and cons of each option, and how they might align with your goals as a driven parent.

The Mega Backdoor Roth: A Better Option Than a 529 to Pay for College?

Does your retirement plan give you the option to save large amounts of money in a Roth IRA? If so, you should take advantage of this unique opportunity.

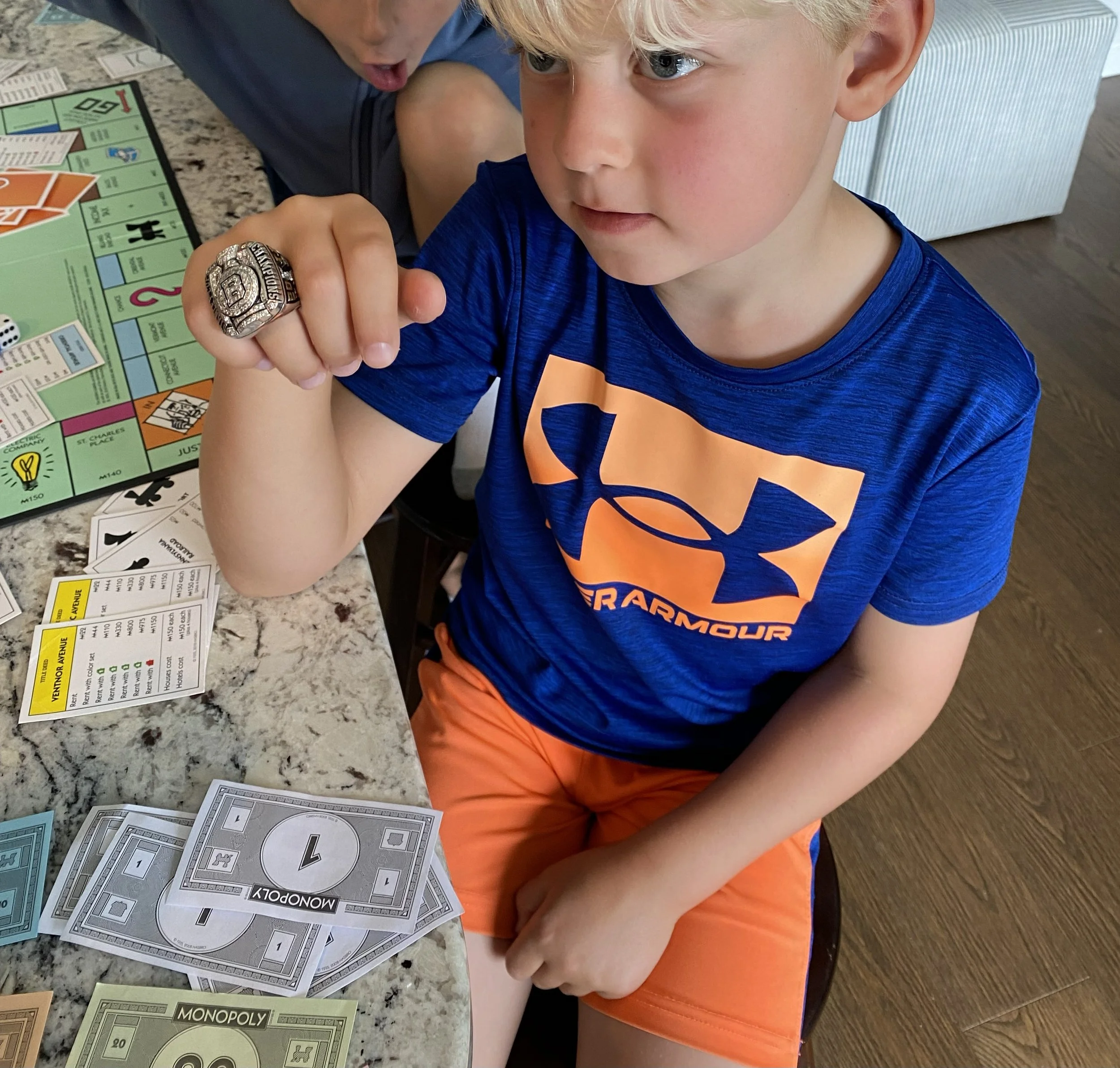

Teaching Kids About Money: A Guide to Financial Literacy for Children

Financial literacy is an essential life skill that is often overlooked in traditional education.